You’ve probably heard the phrase, “living within your means.” But what does it really mean?

Simply put, if you’re living within your means, you can pay for the things you need without getting trapped in more debt than you can handle

Here are the 8 core foundations of living within your means we follow here at ManagingMyMoney.

Know How Much Money You Make

Table of Contents

This may sound like a silly thing to point out, but it’s surprising how many people don’t really know how much money they make. When asked the question, I often hear:

- I make $11.25 per hour

- I make $40,000 per year

While the statements may be accurate, they are referencing one’s gross income (apologies for using a dreaded “tax” term).

Gross income, also known as gross pay, is an individual’s total pay before taxes or other deductions. This includes income from all sources and is not limited to income received in cash, but can include property or services received.

Source: Investopedia.com

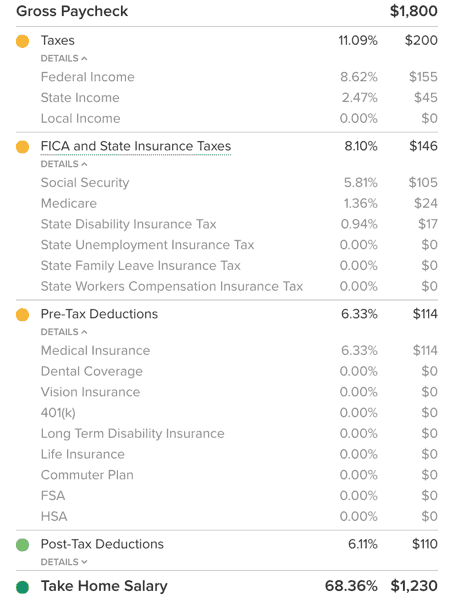

Let’s say you make $11.25 per hour, you work 40 hours per week, and you get paid once a month, that equates to your gross pay being $1,800.00 per month. At the end of the month, you NEVER see a deposit for $1,800.00! There are things that automatically get deducted such as:

- Taxes – on your gross paycheck

- Taxes – Govt Insurance

- Elective Deductions – medical insurance, etc

- Other Deductions – child support, etc

In the example above, the Gross Pay is $1,800.00 but what actually got deposited was about 79% less, or $1,230.00.

In reality, knowing how much money you make is not nearly as important as knowing how much you get to keep. In the example above, it doesn’t matter that you make $11.25 per hour, or $1,800 per month, all that matters is how much you get to keep, and that number is $1,230. That is a lot less than $1,800!

What really matters is that you only get to keep $1,230.

The above is just an estimation. The only thing that really matters is the amount shown on your

Know How Much Money You Spend

Sounds simple enough, right? In our talks with most people, maybe 1 out of 1,000 people know how much they spend every month. So why is it so hard to know where all the money is going? Credit cards.

Paying for things using a credit card is easy. It’s almost easier to pay for things with plastic than cash! So the problem is, you have your paycheck going into your checking account. You take some cash out. You also pay some utility bills with a check. And you put all of the miscellaneous stuff on a store or gas card.

What happens is, you pay for stuff 3 different ways, but they are getting withdrawn from 2 different accounts (Checking and Credit account).

If you paid off your card debt every month, then you’d be able to easily figure out how much money you spent every month. But if you don’t, and according to a Federal Reserve report referenced by Credit

You see, many confuse paying the minimum due on a card, neglecting the interest on the balance carried forward, and thus incorrectly know how much they put every month on plastic. Without knowing that information, there’s no way you can establish a budget!

In actuality, it’s easy to figure out. A checking out will publish every month a Statement, and in this statement they will list 2 things at the top:

- Credits

- Debits

And with a credit card, they will also list the same 2 items, but they may be labeled differently, or a little confusing to find.

In the real world, people usually shell out money in cash, check, debit card, credit card, and maybe 1 or 2 more types of cards (retail store card, gas station card, etc). Making it difficult to know how much money flows out every month.

But this is, in our opinion, one of the MOST IMPORTANT THINGS TO TRACK every month.

Stop Relying On Credit Cards

Many of us believe that the only way to have nice things is to go into debt to get them. While that may be true for some large purchases such as a house or car, it doesn’t have to apply to the other things we need in life.

For example, when you acquire a house, you take out a mortgage, and you may be in debt for as long as 30 years. That’s a long time, but this type of debt comes with benefits. The interest you pay on the loan may be deducted from your taxable compensation, and the equity, or money you have in the home, may be used for future loans. Making regular mortgage payments also helps you build a strong credit rating.

However, buying food, clothes, toys, furniture and other items on credit is different. By doing this, you may be going into debt to buy nonessential things. Plus, the interest charged is not tax-deductible, so by the time you’ve paid for the item and all the interest, the cost is much higher than the original price.

Save Up For Purchases Instead Of Putting Them On Credit Cards

Remember when you were a kid and you didn’t have access to plastic, a loan, or any form of credit? If you wanted to get that certain toy, you had to save money for it. That usually took months!

As an adult, we need to get back to this thinking. Pay for things in cash, not credit. I know instant gratification is something we’ve been accustomed to with these cards, but the art of saving money for those items you want (vs need) is something that you can learn to do again.

We should probably define the types of purchases to save up for, which are Want Expenses. The types of expenses we talk about on this blog, which are ultimately defined by you, are:

- Mandatory Expenses: Expenses required for shelter, supporting your job, etc. Mortgage, Rent, Car Insurance, car gas, Daycare, Electric Bill, Water Bill, etc

- Optional Expenses: Expenses required for comfortable living. Entertainment, clothes, shoes, groceries, dining out, etc.

- Want Expenses: New car, bigger TV, etc

So the challenge when you start to eye something, do you consider it Mandatory, Optional, or a Want. Anything considered a Want Expense should be paid in full, rather than on credit.

Simply put, you’re robbing yourself, and your future. Instead of funding your dreams and the life you deserve to live, your hard-earned money fills the lender’s pockets. Wouldn’t it be better if the money you pay in interest could go into a savings account to help you reach your goals? Paying for everyday items by going into card debt limits your choices because you’re constantly caught paying for yesterday instead of moving toward tomorrow.

Think Of The Cost Rather Than The Monthly Payment

One of the credit traps you should avoid is thinking of the monthly cost of an item rather than the total cost of that item. One of the first things I did as a newly commissioned officer in the US Army was to buy a car and rent an apartment. I needed the car to be successful at my job and I needed a place to stay for shelter.

The first place I went was a new car dealership, and of course, even though I was there to look at a used car I saw in the classifieds, the car salesman pushed me towards a new car. I had a pre-approved car loan and it was something like $200 per months for 24 months. He showed me a new car for the same $200 months over 60 months using their lender.

Hhhhmmm…… sounded like a really good deal, right? Drive a new car for the same monthly payment? A couple of things that immediately become a non-factor when thinking in this fashion are:

- Interest Rate? One thing we didn’t even discuss was that the interest rate was double of what I had with my bank. And I’d be paying that interest for a total of 60 months!

- Am I buying it at a fair price? Payment was the focus, not the purchase price of the vehicle.

I wisely left the dealership, bought me a used Toyota Celica with 150,000 miles, a bunch of rust, faded paint, requiring minimal repairs. It didn’t look good, but it fit my pay grade level, I drove it for 3

The overall cost of ownership of that car, at that time of my life and earnings level, fit me perfectly. The big concern I had was I had $10,000 in student loans to pay, which I factored

I could also tell you the story about how I got a loan to buy a bunch of furniture, but I’d rather not discuss that failure of confusing a need with

Boost Your Income

Most people think the easiest way to balancing wages with purchases is to cut expenses. That is definitely one method.

The other way to live in balance is to increase your paychecks. That could be taking a second job, having your significant other go back to work, or starting a side business. Raising the proceeds into your budget may allow you to lower or even eliminate your need to cut your bills.

These are all valuable ways to increase your pay. Our favorite, being entrepreneurial at heart, and looking for passive income is starting a side business. We’ll have a whole section dedicated to this topic in the future.

Build An Emergency Fund

Once you achieve living in harmony with your bills, the next step is living below your means. When you get there, it is when you can start saving money. Businesses call it, “being in the black” versus “being in the red”. Personal finance guru’s call it being cash flow positive.

This is the time to start building that fund for rainy days. It will enable you to resist tapping into credit for an emergency. Once that happens, you end up on a slippery slope of credit again.

I learned the base of my personal finance plan from my mom at a very young age. She was a single mother, raising 4 kids by herself.

I still remember noticing the steel threads sticking out from the bald tires on her car. I told her, “mom, that looks dangerous. You need to buy new tires!”. Her response, “I know. I should have replaced them months ago. But I already spent our piggy bank on other items. I don’t want to get a loan but I may have to do that”.

She had to go thru the process of going to her credit union to get a

My mom did a great thing having a savings for emergencies, and was doing better than most that never had one to begin with.

The moral of the lesson was that life will thru your curve balls. You can’t prepare for all of them, but you can try to prepare yourself as best as possible. Only when you have a balanced budget and an emergency fund can you truly be financially independent.

Spend Less Money Than You Bring In

This is the holy grail of this article. Spending less money than you bring in is essential to living in harmony with your wages and expenses and getting to living below your means.

Later in life, I knew of many people making six-figure compensation that were broke with massive amounts of debt. One of those people was my neighbor. We lived in a rental house and he owned a $1.2M home (or should I say was paying $8,000 per month mortgage on a house that was still owned by his bank) but didn’t have the cash to pay for a little thing like a car wash. He was trapped, broke, and hoping he never got fired or laid off. His car always had a perpetual coat of dirt covering its faded white paint and it was the eyesore of the street.

He had software development skills that

Conclusion

Living a life you can afford can be challenging at first, a bit humbling, and may not be accepted by your loved ones. But you’ll quickly adjust, with the eventual goal of living below your means, spending less, and building a

You May Also Like These Posts

[wp_show_posts id=”1827″]

Back To You

Do you have any tips or advice on living within your means?

Thank you much. These are simple, common sense steps I can follow.

Very useful article